Women: Addicted to Stress, Fear & Money?

Friday, November 11, 2011 at 9:19AM

Friday, November 11, 2011 at 9:19AM  1 Comment

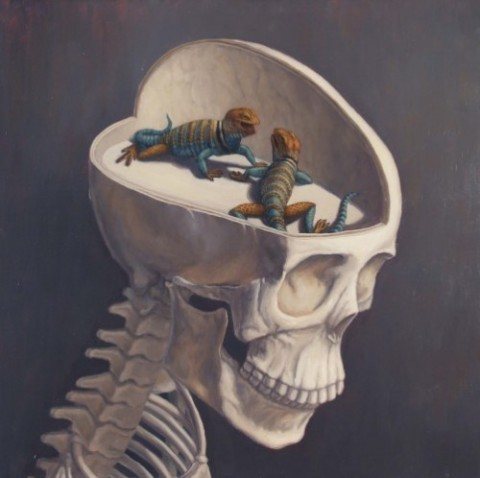

1 Comment Ever spend money to calm the stress of a hectic, demanding week? Or grabbed your second Starbucks of the day because you deserve something good? These are examples of what we do to make ourselves feel better when the brain is stressed. We humans like to "think" we are so rational, but don't believe it. Stress makes us much more vulnerable to making less than good decisions. Hello weight gain and expanding credit card debt!

much more vulnerable to making less than good decisions. Hello weight gain and expanding credit card debt!

But are we addicted to stress and fear? "The more we reach for the doughnut (the Starbucks, the new shoes) without being conscious of how we're feeling - anxious, stressed, unhappy- the more we cement in the fear that's driven us to reach for it in the first place. In fact, the more we deny our fears with distractions, the more compulsive we become." (Lynn T.S. Intentional JOY)

Ted and Brad Klontz state that the human brain under stress is like a tilted table. Anxiety and fear make us feel off-balance and the brain then looks for ways to rebalance. (Mind Over Money.) Of course, our advertiser based, consumer culture supplies us with plenty of suggestions (commercials anyone?) that sit under the surface waiting for the perfect moment - Friday night, kids fighting in the back seat, dinner to be prepared at home - blam - McDonalds here we come.

An important thing to remember is none of this is really bad or wrong. We are human, flawed and imperfect. That's the deal. We also have choice. It's ok to want to calm, soothe and comfort ourselves. But, how? The gift of being human is that we have the ability to wake up, to become conscious and to practice new behavior. Think  about this: Imagine the consequences of more healthy stress relievers? Yoga, breathing, a walk, a talk with a friend are all proven stress busting, brain calming methods that don't leave a residue of guilt. Or, do you continue to seek the easy solution and end up feeling worse over the long run? Start with baby steps. Awareness there's a problem is that first step.

about this: Imagine the consequences of more healthy stress relievers? Yoga, breathing, a walk, a talk with a friend are all proven stress busting, brain calming methods that don't leave a residue of guilt. Or, do you continue to seek the easy solution and end up feeling worse over the long run? Start with baby steps. Awareness there's a problem is that first step.

Lynn Telford-Sahl tagged

Lynn Telford-Sahl tagged  addiction,

addiction,  bad money decisions,

bad money decisions,  fear,

fear,  financial stress,

financial stress,  intentional joy,

intentional joy,  mind over money,

mind over money,  money addiction,

money addiction,  money stress,

money stress,  stress,

stress,  ted klontz,

ted klontz,  the addicted brain,

the addicted brain,  the stressed brain

the stressed brain